Executive Summary

ttt

-

The possibility of Iran blockading or closing the Strait of Hormuz is unlikely unless escalation leads Iran to feel its regime is under immediate existential threat. If the agreed ceasefire is not honoured, this is likely to increase tensions.

-

There is a realistic possibility of Iran causing disruption to vessel traffic via missile and drone attacks, seizure of vessels or naval mines.

-

It is highly likely that western insurers will enforce higher war risk premiums in the Persian Gulf and Gulf of Oman.

Situation in General

- Operation Rising Lion: On 13th June 2025, the Israel Defense Forces (IDF) launched a coordinated aerial campaign called Operation Rising Lion, targeting Iran’s nuclear infrastructure and military installations, killing several key military leaders and nuclear scientists. Iran retaliated with air strikes focusing on Tel Aviv, many of which were intercepted by air defence but have still caused fatalities. In the days since, the two countries have exchanged strikes across several targets, including the targeting of one of Iran’s largest fuel storage and distribution hubs at the Sharan depot and strikes on Israel’s largest oil refinery at Haifa.

- Operation Midnight Hammer: US forces further escalated the situation on 22nd June, when US assets targeted key Iranian nuclear facilities under an operation called Midnight Hammer, an action that caused the US Udeid airbase in Qatar to be targeted by Iranian missiles the following day. The attack caused limited damage and no injuries. Reports indicate that the United States received an advanced warning of the attack through an Iranian communique to Qatar. It is highly likely that this attack was largely a symbolic response.

- Ceasefire: Following the targeting of Udeid airbase it was announced on 24th June that the US and Qatar had brokered a ceasefire which was agreed by Israel and Iran at 0600 UTC. It is highly likely that the attack on the Udeid airbase within Qatar had facilitated this co-operation. Both Israel and Iran claimed this ceasefire as a victory despite violations by both sides.

Recent Maritime Incidents

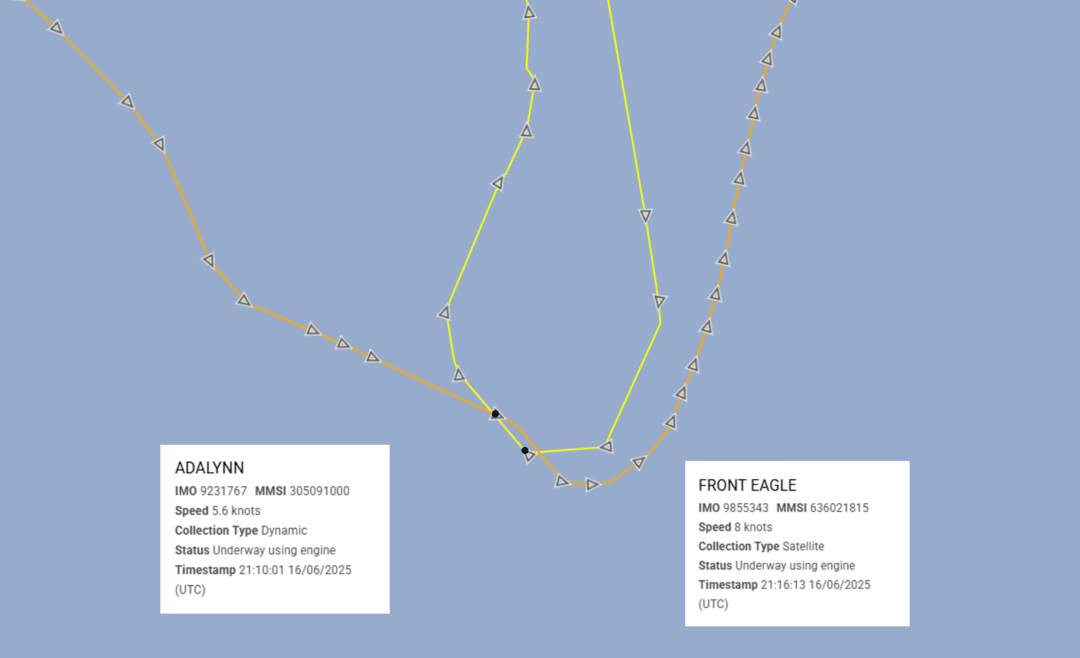

17th June – Vessel fires. The Antigua and Barbuda-flagged tanker ADALYNN (IMO:9231767) and the Liberia-flagged tanker FRONT EAGLE (IMO: 9855343) collided within the Khor Fakkan anchorage, Oman, resulting in onboard fires. Beyond the immediate threat to crew and vessel integrity, there is an environmental risk due to potential spills and risk for maritime safety in the immediate area.

It is unlikely that the collision was caused by interference, as the AIS of both vessels was transmitting normally at the time. Circumstances suggest that the cause was likely accidental or due to negligence and not related to any indirect effects from the conflict, particularly as the ADALYNN is a suspected Russian shadow fleet vessel, known for poor safety procedures and maintenance.

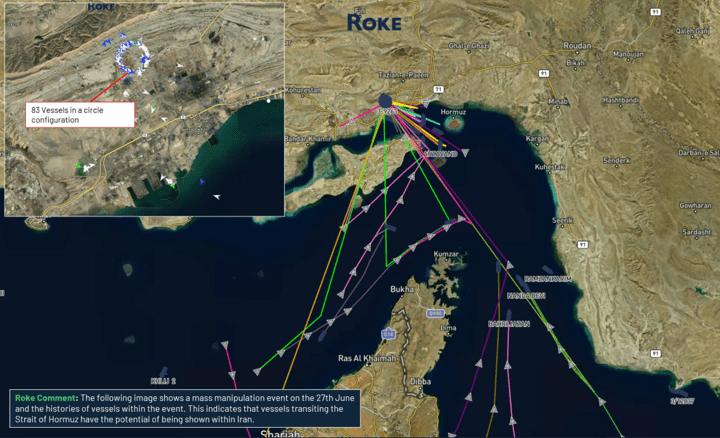

16th June – AIS interference. The UKMTO has reported the receipt of multiple reports, corroborated with AIS monitoring of increasing electronic interference within the waters of the Gulf and Straits of Hormuz. Whilst the level of electronic interference continues to rise across the wider region, the levels and intensity inside the Gulf are having a significant impact on vessels positional reporting through automated systems (AIS).

The agency is urging ships to exercise more caution whilst navigating the area and continue to report incidents of electronic interference. The agency did not name the source of the increased interference but is likely due to increased use of military electronic warfare systems in the region for GPS disruption to mitigate drone and missile strikes. This will likely reduce in intensity if the ceasefire remains.

Strait of Hormuz Closure Risk

Iran has historically used the closure of the narrow strait as a recurring rhetorical tool. However, with China being the top importer of Iranian oil, any disruption to traffic navigating the Strait of Hormuz would almost certainly see an increase of crude prices and negative effect upon Chinese /Iranian bilateral relations.

Closing the Strait of Hormuz would also almost certainly affect global energy markets, highly likely drawing a swift response from the US. Despite reports of the Iranian parliament voting in support of closing the Strait of Hormuz prior to the ceasefire, this would be a high-risk action for Iran which would likely only be taken as a last resort.

The possibility of Iran blockading or closing the Strait of Hormuz is unlikely unless escalation leads Iran to feel its regime is under immediate existential threat.

The Supreme Leader of Iran has the final say on any major political, military and ideological matters and prior to this the Guardian Council has the authority to review all legislation passed by the Iranian parliament. However not every vote by Parliament automatically becomes law. A decision on the Strait of Hormuz would likely be subject to the national security council before any action is taken.

It is likely that the reports of the vote by the Iranian parliament amount to posturing, to gain support and increase pressure internationally

With the Strait of Hormuz being strategic and economically significant, its closure would cause a significant effect on global energy markets with even the threat of any disruption causing global oil prices to spike. If either country were to breach the ceasefire agreement and the conflict was to resume, the probability of Iran closing the Strait of Hormuz would remain low and unlikely.

There is a realistic possibility of Iran causing disruption to vessel traffic in the Strait of Hormuz. The most likely tactics would be:

- Naval mines. This is the most immediate option Iran has for disrupting shipping. These mines could be deployed rapidly by a wide array of vessels, including the IRGCN’s fleet which includes a range of modified small boats. Additionally, Iran has shown the ability and intent to use small boats to directly plant limpet mines on the hulls of civilian ships. This was observed in the case of oil tanker KOKUKA COURAGEOUS in 2019.

- Seizure of vessels. The IRGC’s Navy frequently seizes foreign vessels that it claims are transporting smuggled oil. Moreover, it has seized vessels to retaliate and seek leverage against governments worldwide. It is likely that tactic would be directed at Israeli-owned and operated shipping.

- Missile and drone warfare. Iran has been steadily developing an arsenal of drones both seaborne and aerial; there is a threat of these being employed as the situation develops. These could be launched from land or sea, as in recent years Iran has converted several civilian vessels into motherships for launching missiles and drones. IRGCN units train to use hit-and-run ‘swarm’ tactics with these small, mobile boats against larger enemy naval vessels.

Image 1: Limpet mine damage on the KOKUKA COURAGEOUS, Source: Sky.

Image 2: An IRGCN ‘mothership’ carrying small boats and drones, Source: Iran Press.

Iran: Next Steps

Reporting on the effectiveness of the US strikes is mixed and as yet unclear until a full assessment takes place. An initial US intelligence assessment leak indicated that the Iranian nuclear program will only have been delayed by months.

However the Institute for Science and International Security assess that Iran’s enrichment capabilities have been effectively destroyed, despite the country still having enriched uranium stockpiles.

On 1st July, Iran’s foreign minister stated that the Fordow facility was ‘seriously and heavily damaged’.

On 25th June, Iran’s Guardian Council approved a bill to suspend its cooperation with UN nuclear watchdog the International Atomic Energy Agency (IAEA). Whilst extant inspectors remain present in Iran, they are not currently permitted access to the sites, preventing an impartial damage assessment.

With both Israel and Iran claiming the ceasefire as a victory and the subsequent victory parade in Tehran, Iran will likely not retaliate further, but concerns remain present.

The Institute for the Study of War assesses that a total of 483 missiles were intercepted out of 543 Iranian ballistic missiles that were launched against Israel. This low success rate of 11% and the threat of further US action highly likely contributed to the decision of Iran to accept a ceasefire.

Iran will likely continue to uphold the ceasefire unless further missiles are launched from Israel, in which case retaliation will be likely. Proxy groups like Hezbollah, the Houthis and Iraqi-based groups are likely to intensify operations, especially any groups that disagree with the current ceasefire. There is a realistic possibility that this may be through further commercial maritime targeting occurring in the Red Sea and Gulf of Aden.

Get in touch

If you need real time insights for your organisation, click the button below to contact us and discover how our expert analysts can support you.